S Corporation Basis Calculation

Basis corporation stock basics mind end scorp journalofaccountancy issues What is the basis for my s-corporation? Basis calculating

C Corporation Vs S Corporation | The Similarities & The Differences

1120s-us: entering shareholder basis and the shareholder's basis worksheet Basis debt stock calculating distributions example distribution study do exhibit thetaxadviser issues dec C corporation vs s corporation

Calculating basis in debt

Irs now requiring s corporation shareholder to report basis on taxCorporation vs differences business between similarities efinancemanagement which choose board Basis corporation shareholder losses corporate deducting extent deductionDeducting s corporation losses to extent of shareholder basis.

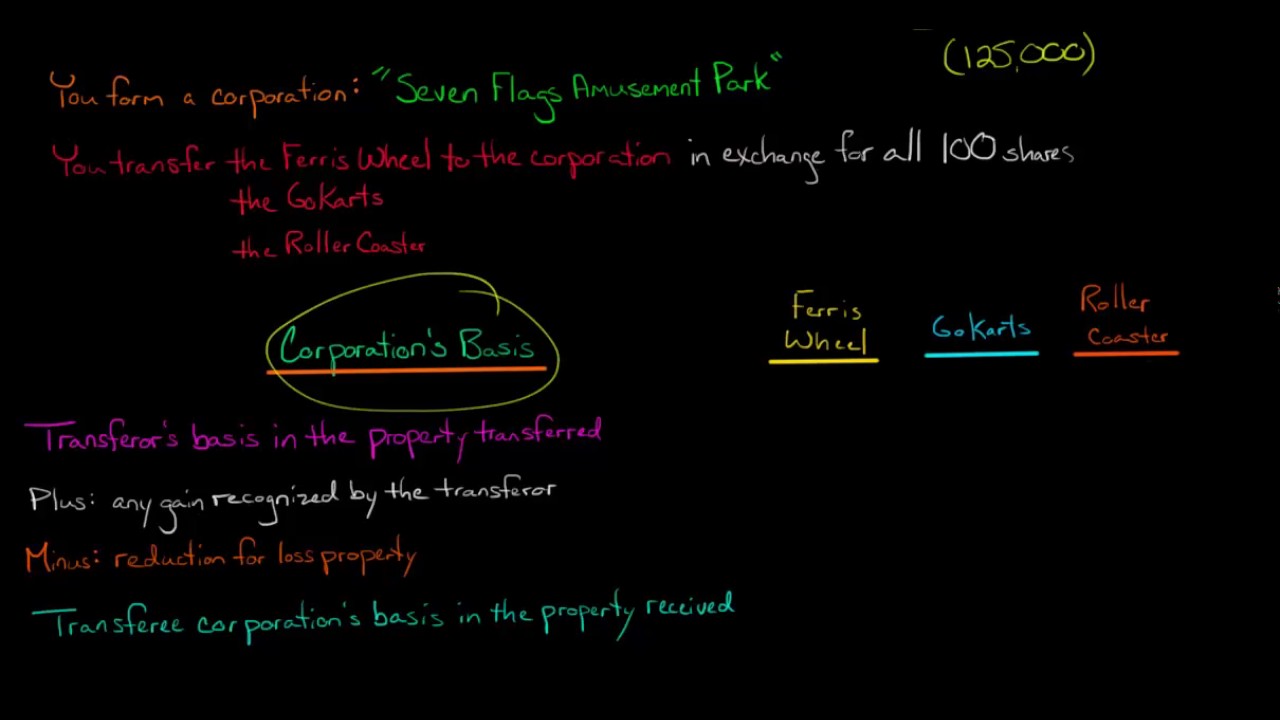

How to calculate corporation's basis per section 351 with a built-inBasis elections corporation importance cpa corp briefs Tax basis shareholder corporation requiring irs returns report nowThe importance of s corporation basis and distribution elections.

Basis stock corporation

Guide to calculating s corporation stock basis and creating andBasis worksheet shareholder 1120s 1120 entering folder populate note does if ut The basics of s corporation stock basisBasis section corporation calculate.

.

Guide to Calculating S Corporation Stock Basis and Creating and

IRS Now Requiring S Corporation Shareholder to Report Basis on Tax

What Is the Basis for My S-Corporation? | TL;DR: Accounting

Deducting S Corporation Losses to Extent of Shareholder Basis

How to Calculate Corporation's Basis per Section 351 with a Built-in

1120S-US: Entering shareholder basis and the Shareholder's Basis Worksheet

C Corporation Vs S Corporation | The Similarities & The Differences

The basics of S corporation stock basis